Qualifications For An Sba Loan . Joel soforenko is an industry veteran having extensive experience with sba 7(a), sba 504 and usda loans. Ad graduate student loans for international students.

Sba 504 loan repayment periods can last 10, 20, or 30 years. As a lender, these conditions determine which businesses you can lend to and the type of loans you can give When it comes to your personal credit score, a.

Qualifications For An Sba Loan. In addition to the eligibility requirements, there are a few additional qualities which can increase your likelihood of sba 7 (a) loan approval. Make all the right money moves Sba 504 loan repayment periods can last 10, 20, or 30 years. Repayment terms cannot exceed six years. A business loan can be a great way to obtain this capital. Similar to sba 7 (a) loans, cdc/sba 504 loans require a credit score of 680 and have a maximum loan amount of $5,000,000.

Qualifications For An Sba Loan ~ As We know recently has been hunted by consumers around us, perhaps one of you personally. Individuals are now accustomed to using the internet in gadgets to see video and image information for inspiration, and according to the title of the post I will talk about about Qualifications For An Sba Loan .

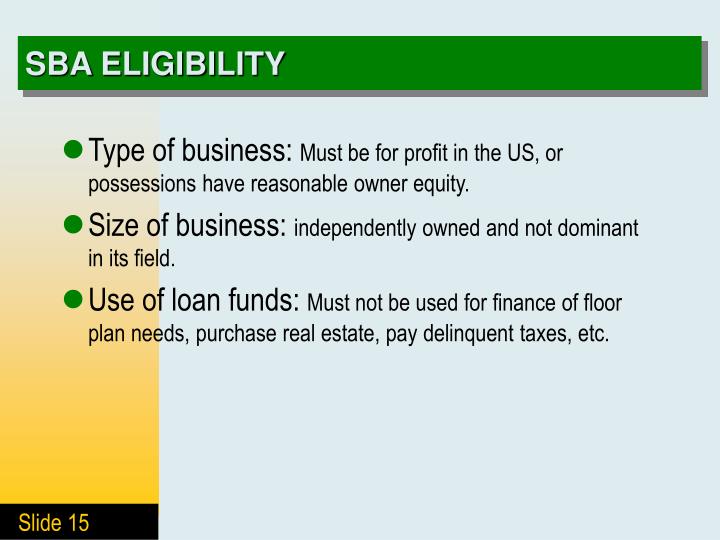

In a majority of cases, you’ll pay back your loan on a monthly schedule. To be eligible for the 7(a) and 504 loan programs under the alternative size standard, a business must have net worth under $15 million and an average net income of less than $5 million over the past two years. Two types of credit scores are considered for sba loans: The sba sets the guidelines that govern the 7(a) loan program. Qualifying for an sba loan. He has assisted borrowers as a loan originator, processor, underwriter and manager of the sba department of a major origination platform. Whichever type of sba loan you choose, it's important to understand the basic pillars of loan eligibility. Ad graduate student loans for international students. Mba, masters, any graduate degree. The fee is a percentage of the amount guaranteed under the sba express loan program, or 3% on the guaranteed portion of loan amounts between $150,001 and $350,000. To learn more or to apply, visit sbaexpress.loans.

Qualifications For An Sba Loan Sba loan requirements & how to qualify.

This is to ensure that even though you are a new or a small business, you are capable of meeting your financial obligations. Sba 504 loan repayment periods can last 10, 20, or 30 years. The sba express loan has traditionally been for loans up to $350,000, but recently congress increased the express loan maximum to $1,000,000 until december 31, 2020. If approved, you can expect the following: Have an amount of invested equity that’s deemed reasonable by the sba Mba, masters, any graduate degree. Mpower provides financing for international students studying in the u.s. To be eligible for the 7(a) and 504 loan programs under the alternative size standard, a business must have net worth under $15 million and an average net income of less than $5 million over the past two years. Sba loan requirements & how to qualify. Qualifying for an sba loan. The sba sets the guidelines that govern the 7(a) loan program.

If you are searching for Qualifications For An Sba Loan you've arrived at the right location. We have 20 images about Qualifications For An Sba Loan including images, photos, photographs, wallpapers, and more. In these webpage, we also have number of images out there. Such as png, jpg, animated gifs, pic art, symbol, black and white, translucent, etc.

In addition to the eligibility requirements, there are a few additional qualities which can increase your likelihood of sba 7 (a) loan approval.

He has assisted borrowers as a loan originator, processor, underwriter and manager of the sba department of a major origination platform. Qualifying for an sba loan. Having been in business for at least two years. If approved, you can expect the following: As a lender, these conditions determine which businesses you can lend to and the type of loans you can give A business loan can be a great way to obtain this capital. Get $500 to $5.5 million to fund your business. Sba funds the microloan program at a significant discount, so costs and terms are more reasonable to small business borrowers. Microloans have a max term of 6 years. The sba express loan has traditionally been for loans up to $350,000, but recently congress increased the express loan maximum to $1,000,000 until december 31, 2020. The sba sets the guidelines that govern the 7(a) loan program.