Credit Score For An Auto Loan . Follow this advice to find the best auto loan for the fico score under 426. That’s why there are lenders in the market who specialise in dealing with borrowers with poor credit scores and lend them.

Auto credit express is all about getting you a quick decision on your auto loan. It goes beyond bad or scant credit, even bankruptcies and repossessions, by evaluating your monthly income and recurring debt. About 1 in 6 auto loan borrowers in 2021 had credit scores below 601, according to credit reporting company experian.

Credit Score For An Auto Loan. Types of lenders that offer car loans for bad credit many different types of. Loan rates only mean so much. Restoring your student loans is a significant achievement. A credit score is a numerical representation of the data in your credit report. Auto credit express is all about getting you a quick decision on your auto loan. Follow this advice to find the best auto loan for the fico score under 426.

Credit Score For An Auto Loan ~ As We know recently has been hunted by consumers around us, perhaps one of you personally. People now are accustomed to using the internet in gadgets to view image and video data for inspiration, and according to the name of this post I will discuss about Credit Score For An Auto Loan .

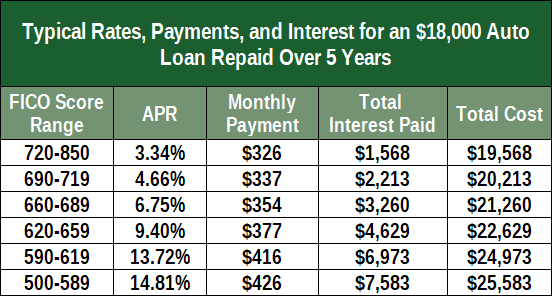

Restoring your student loans is a significant achievement. Helpful hints for securing the best loan possible! Auto lenders use credit scores to determine how likely you are to repay a car loan. A typical credit score ranges somewhere between 300 and 850. Borrowers with a low score are often seen as a. Your credit score has a major effect on whether or not you’re approved for a loan and the total amount you’re approved for. Auto credit express is all about getting you a quick decision on your auto loan. Find out what auto loan rates your 426 credit score can get you in 2022. Bad credit car loans are car financing loans specifically meant for borrowers with bad credit ratings. In most cases, a higher score improves your chances of getting approved for a loan with a low interest rate. Follow this advice to find the best auto loan for the fico score under 426.

Credit Score For An Auto Loan That’s why there are lenders in the market who specialise in dealing with borrowers with poor credit scores and lend them.

Borrowers with a low score are often seen as a. About 1 in 6 auto loan borrowers in 2021 had credit scores below 601, according to credit reporting company experian. Auto lenders use credit scores to determine how likely you are to repay a car loan. Your credit score has a major effect on whether or not you’re approved for a loan and the total amount you’re approved for. Bad credit car loans are car financing loans specifically meant for borrowers with bad credit ratings. Auto credit express is all about getting you a quick decision on your auto loan. When banks or dealers advertise low interest rates, it could be a teaser rate for which only those with the best credit scores can qualify. A high number means you have excellent credit and are likely to pay as agreed. Scores are generally measured on a scale from 300 to 850. That’s why there are lenders in the market who specialise in dealing with borrowers with poor credit scores and lend them. Since such borrowers are considered less creditworthy, getting approved for traditional car loans is usually difficult.

If you are looking for Credit Score For An Auto Loan you've reached the ideal location. We have 20 images about Credit Score For An Auto Loan including images, photos, pictures, backgrounds, and much more. In such web page, we also have variety of images available. Such as png, jpg, animated gifs, pic art, logo, black and white, transparent, etc.

As with most types of borrowing, your approval to borrow and your interest rate depend in part on your credit score and history.

Auto lenders use credit scores to determine how likely you are to repay a car loan. Restoring your student loans is a significant achievement. Find out what auto loan rates your 426 credit score can get you in 2022. A high number means you have excellent credit and are likely to pay as agreed. That’s why there are lenders in the market who specialise in dealing with borrowers with poor credit scores and lend them. Remember, your payment history accounts for a whopping 35% of your fico ® score ☉, which is the credit score used by 90% of top lenders. It goes beyond bad or scant credit, even bankruptcies and repossessions, by evaluating your monthly income and recurring debt. Since such borrowers are considered less creditworthy, getting approved for traditional car loans is usually difficult. A typical credit score ranges somewhere between 300 and 850. Auto credit express is all about getting you a quick decision on your auto loan. Your credit score has a major effect on whether or not you’re approved for a loan and the total amount you’re approved for.